Chairman SECP to face probe, justify overseas trips.

Tariq Khattak

ISLAMABAD (Oct 07)

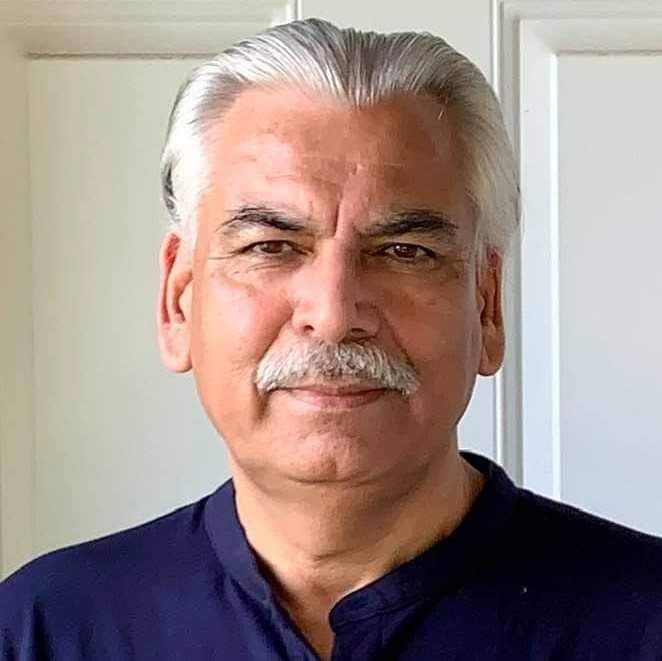

The Senate Standing Committee on Finance and Revenue has urgently demanded that the Securities and Exchange Commission of Pakistan (SECP) Chairman Akif Saeed, to disclose all foreign travel undertaken by senior officials, intensifying scrutiny over spending practices that appear to be misaligned with national austerity measures and the regulator’s stated commitment to transparency.

The committee’s intervention is a response to the public’s right to know about the SECP’s spending. This follows growing parliamentary pressure to reform public sector governance and tighten anti-corruption frameworks.

Internal records indicate that Chairman Saeed, Commissioner Abdul Rehman Warraich, Commissioner Mujataba Ahmed Lodhi and Executive Director Asif Jalal Bhatti have travelled abroad multiple times. Some insiders claim these trips lacked strategic justification and involved lavish accommodation.

Financial experts warn that unchecked travel expenses divert resources from priority regulatory tasks such as investor protection and market stability. Past audits of SECP’s travel budget revealed inconsistencies between allocations and actual spending, prompting calls for independent forensic reviews. Sources have urged a broader probe into the highly objectionable spending practices.

The issue has the potential impact on international partnerships. This includes technical assistance from the World Bank and Asian Development Bank, which could be jeopardized if excessive travel is not curbed.

Business leaders express frustration that discretionary travel continues while regulatory processes at home remain slow and compliance burdensome. Citizens, meanwhile, question how foreign travel by regulators aligns with national economic priorities at a time of high inflation and unemployment.

Insiders have demanded that SECP must maintain a comprehensive register detailing officer names, destinations, dates, costs, funding sources, and documented deliverables. Compliance with the demand will test the regulator’s ability to rebuild credibility as it pursues digital reforms, beneficial ownership registries, and capital market oversight.

Some officials privately suggest that any disclosure will follow internal review procedures. However, few lawmakers insist that transparency on foreign travel remains a test case for the regulator’s credibility at home and abroad. Delayed reporting by SECP may further erode public confidence, while international lenders closely track Pakistan’s fiscal governance standards.

Leave a Reply