Business leaders press for urgent privatization of PIA.

Tariq Khattak

Islamabad (Sept-17-2025)

Pakistan International Airlines (PIA) has achieved a significant milestone, recording an Rs11.5 billion pre-tax profit for the six months ending June 2025. This marks a reversal of two decades of losses, a feat that has created an ideal window for completing the long-delayed privatization.

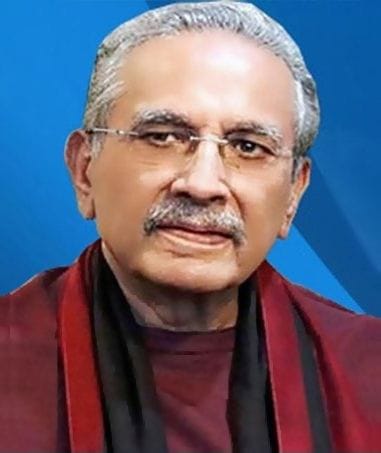

Business leader and former president of ICCI, Shahid Rasheed Butt, hailed the profit milestone as a vindication of government restructuring efforts. He also underscored the urgency of the situation, warning that any delays in privatization could risk squandering the opportunity.

“This is precisely the right time to sell PIA when it shows profitability rather than waiting for another crisis,” Butt told the business community, crediting the administration for transforming decades of losses into sustainable gains.

The turnaround follows the carrier’s first annual profit in 21 years during fiscal 2024, when it earned Rs3.9 billion operationally and Rs2.26 billion net. Net profit for the current half-year reached Rs6.8 billion, though company equity remains negative despite the gains, he said.

Shahid Rasheed Butt informed that finance costs dropped sharply after Islamabad absorbed approximately 80 percent of the airline’s legacy debt in 2024, while high fuel and service expenses continue to pressure operations. Presently, four qualified bidders include domestic airline Airblue, Fauji Fertilizer Company, a Lucky Cement-led consortium comprising Hub Power, Kohat Cement, and Metro Ventures, plus an Arif Habib consortium with Fatima Fertilizer, City Schools, and Lake City Holdings.

Privatization is expected to conclude in a few months, although it may take longer. Britain’s July decision to lift its five-year ban on Pakistani airlines provides additional momentum. The carrier had previously survived only through regular government bailouts, with planes seized abroad and flights canceled due to mounting debt. PIA estimated annual revenue losses of around Rs40 billion from the British restrictions, with London, Manchester, and Birmingham among its most profitable routes.

The privatization represents Pakistan’s first major state asset sale in two decades, forming a central component of the IMF bailout agreement. Divestment of loss-making enterprises aims to reduce fiscal burden while improving operational efficiency through private management. However, structural challenges persist despite the improved financials. The airline recorded earnings per share of Rs5.01 for 2024, but negative equity indicates continued vulnerability. Staff reductions and route rationalization contributed to cost savings, though employment implications remain contentious among labor unions.

The bidding process includes safeguards for employee rights and service continuity, addressing workforce concerns about job security under new ownership. Two initial applicants were disqualified for failing to meet operational standards, indicating government scrutiny of technical capabilities alongside financial offers.

Mr. Butt said that restored access to European and British markets expands revenue potential for future owners. And successful privatization could establish a precedent for divesting other state enterprises under IMF conditionalities. Final bids are expected between October and December 2025, with the due diligence phase ongoing for qualified bidders. Senate committee oversight continues through completion of the sale process.

Household air travel costs may stabilize through improved efficiency, while employment effects depend on new ownership restructuring plans. The potential for export competitiveness to improve via enhanced connectivity to international markets could bring a new wave of optimism to the business community.

Leave a Reply