Import-export gap threatens industrial base, currency and jobs.

TARIQ KHATTAK

Islamabad (December-07-2025)

Pakistan’s widening trade deficit highlights critical structural issues in manufacturing and export competitiveness, which should concern policymakers about potential industrial instability and economic resilience, a noted trade leader warned on Sunday.

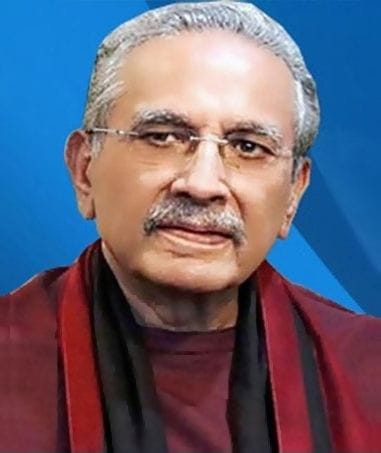

Responding to Pakistan Bureau of Statistics data showing the trade deficit surged 37.17 percent to 15.47 billion dollars in the first five months of fiscal year 2026, former president of the Islamabad Chamber of Commerce, Shahid Rasheed Butt, said the figures expose a deepening crisis where industries consume imported inputs but fail to generate competitive exports, risking long-term economic stability.

He pointed to November as particularly alarming, with exports declining 15.35 percent year-on-year to 2.398 billion dollars while imports rose to 5.253 billion, pushing the monthly deficit to 2.85 billion. He said the export-to-import ratio has deteriorated to 0.45 from 0.53 last year, indicating export sectors are losing ground even as they absorb more raw materials.

He identified several factors driving the collapse. Cheap imports are undercutting domestic producers while factories struggle with outdated technology, an unreliable energy supply, weak export financing, and an inability to meet international quality standards. This creates a vicious cycle where rising input costs fail to translate into export earnings, accelerating deindustrialization.

He said short-term consumer gains from cheaper imports mask severe long-term risks. Factory closures will eliminate formal jobs in export zones. At the same time, currency depreciation will push up inflation on imported essentials, including fuel, edible oil, and medicines. Rising external debt servicing will squeeze fiscal space for health and education.

Mr Butt called for immediate corrective measures, including tariff rationalization to protect viable industries, subsidized energy for exporters, and diversification incentives beyond textiles into IT services, pharmaceuticals, engineering goods, and value-added agriculture, to prevent further depletion of foreign exchange reserves and avoid another IMF bailout with stricter conditionalities and deeper austerity.

The persistent erosion of the trade balance also carries strategic weight. Diversifying export markets and products is essential not only economically but also for safeguarding Pakistan’s sovereignty and future independence, reinforcing the need for long-term, structural policy reforms for national resilience.

Leave a Reply